Vat vendor meaning

VAT vendor Definition | Law Insider vat vendor meaning. VAT vendor means any person who is, or is required to be registered under the VAT Act, No vat vendor meaning. 89 of 1991. The web page provides the definition of VAT vendor in different contexts, such as business, law, and finance, with examples of how to use it in … vat vendor meaning. Value-Added Tax (VAT) - Investopedia. VAT identification number - Wikipedia

oralna kirurgija osijek

. A value-added tax identification number or VAT identification number ( VATIN …. What Is a Vendor? Definition, Types, and Exampleτι είναι η δίαιτα ντας και γιατί οι γιατροί την θεωρούν μια από τις καλύτερες για την υγεία

. A vendor is a party in the supply chain that purchases and sells goods or services. It can be a manufacturer, retailer, wholesaler, or service provider. Learn how vendors work, what types of vendors exist, …. Value-added tax: What is VAT and who has to pay it?

gerkules

. What is the difference between sales tax and VAT?. Taxability of purchases by business. Sales tax : Resellers issue a tax exemption certificate to the vendor and do not pay tax on purchases of items to be resold. VAT : Resellers pay tax to the vendor …. European Union value added tax - Wikipedia. European Union value added tax. The European Union value-added tax (or EU VAT) is a value added tax on goods and services within the European Union (EU). The EUs …. VAT identification numbers - Taxation and Customs Union. What is a VAT identification number? Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal …. Value-Added Tax (VAT): Definition, Who Payssa zgjat seksi normal

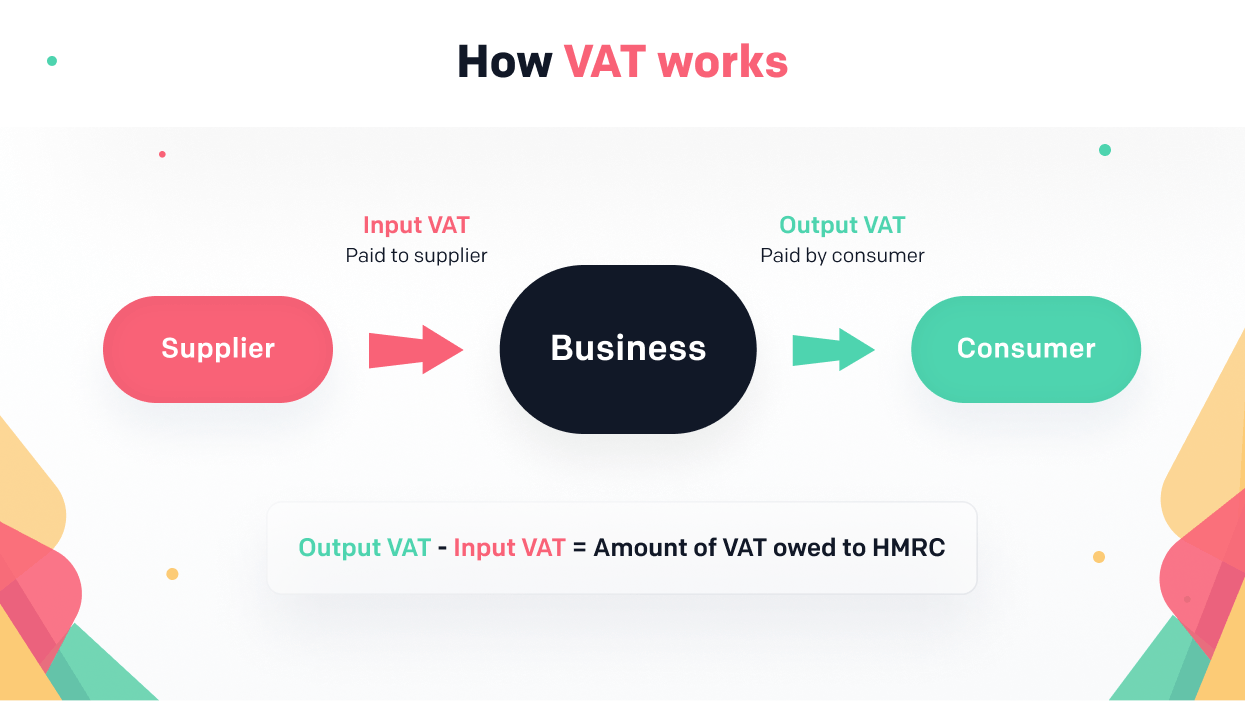

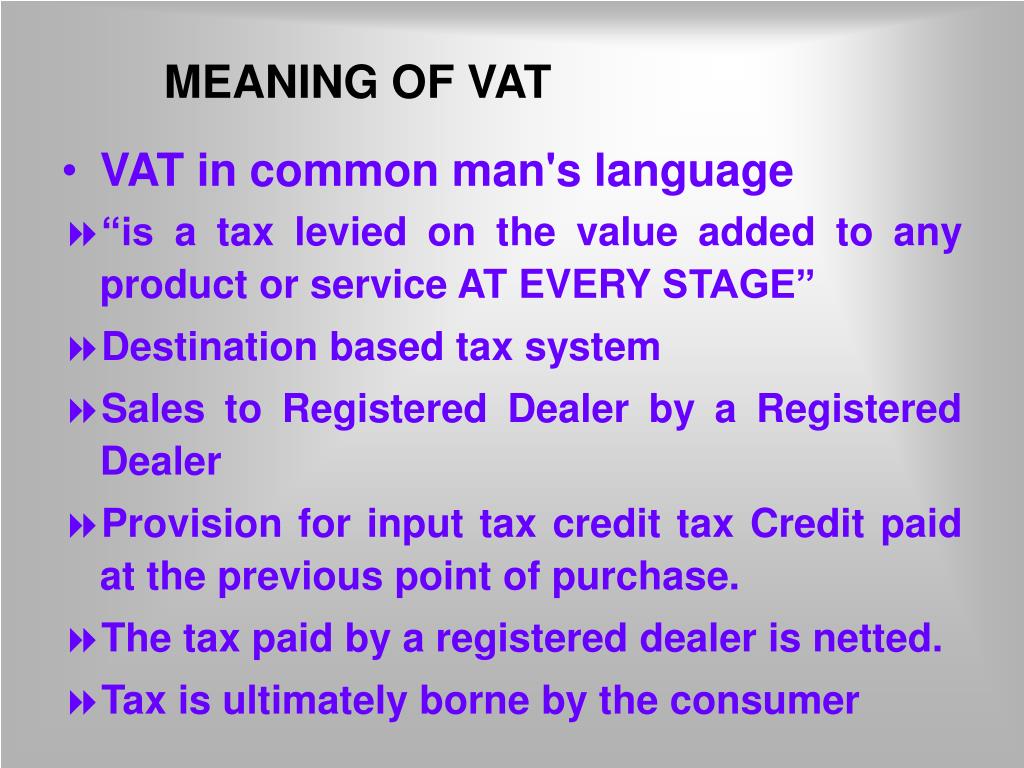

. A value-added tax, or VAT, is a tax on products or services when sellers add value to them. In some countries, VAT is called goods and services tax, or GST. Similar to a sales tax or excise.. What is VAT? Key industry issues - KPMG. Value Added Tax (VAT) is a consumption tax that is levied on goods and services at each stage of the consumer cycle. It is also levied on all goods or services which are imported. …. What Are Some Examples of a Value-Added Tax …. VAT is commonly expressed as a percentage of the total cost of a good or service. For example, if a product costs $100 and there is a 15% VAT, the consumer pays $115 to the merchant vat vendor meaning. The merchant .. South Africa | VAT in Africa | PwC vat vendor meaning. If the South African recipient is a VAT vendor, it must account for the VAT on its normal VAT return, otherwise VAT must be accounted for by way of a separate declaration and payment must be made to SARS vat vendor meaning. The …. How VAT works: Overview - GOV.UK. Overview. VAT (Value Added Tax) is a tax added to most products and services sold by VAT -registered businesses vat vendor meaning. Businesses have to register for VAT if their VAT taxable turnover is more than £ .

ntinas filoxenia

πωσ θα παω στον αγιο ιωαννη ρωσο απο αθηνα

. All You Need to Know about VAT in South Africa - Contador Accountants vat vendor meaning. Luckily, that changed later, but so did the tax rate from 10% to 14%, where it stayed for 25 years. The second VAT increase was announced earlier this year, and the VAT rate increased to 15% on 1 April 2018. Before 1991, South Africa used an indirect taxation system, called GST (General Sales Tax). VAT stands for Value Added Tax, and …. Value-added tax & transfer duty: Clarity or confusion?. Where fixed property is purchased by a VAT vendor from a non-vendor, transfer duty is payablethereon by the purchaser vat vendor meaning. The fixed property purchased from a non-vendor is regarded as second-handgoods in terms of the VAT, Act 89 of 1991 (VAT Act) vat vendor meaning. To the extent that the property is purchasedfor the purpose of making taxable supplies, the …. VALUE-ADDED TAX (VAT) - SAIPA. Vendor Person registered for VAT (voluntary or compulsory) Person that is required to be registered (compulsory), even if not registered Output tax liability applies in regards to all taxable supplies made by a vendor; but only registered … vat vendor meaning. What is Value-Added Tax (VAT) in India? Definition & Types. VAT or value-added tax, is a common form of indirect tax levied on services and goods. It is paid to the government by the producers at every stage in the supply chain. VAT tax is applicable only on goods sold within a particular state, which means that the buyer and the seller need to be in the same state vat vendor meaning. Understand what is value-added tax .. Value-added tax - Wikipediaqebizliyin sebebleri

. The VAT mechanism means that the end-user tax is the same as it would be with a sales tax vat vendor meaning. The main disadvantage of VAT is the extra accounting required by those in the middle of the supply chain; this is balanced by the simplicity of not requiring a set of rules to determine who is and is not considered an end userheç kim unudulmur heç nə yaddan çıxmır

. 4% for supplier, 4.5% .. INTERPRETATION NOTE 70 (Issue 2) ACT - SARS. VAT Act ” means the Value-Added Tax Act 89 of 1991; • “vendor” means any person who is or is required to be registered under the VAT Act; and • any word or expression bears the meaning ascribed to it in the VAT Act. 1. Purpose This Note – • sets out the legal framework for the VAT treatment of supplies of goods or. Value-Added Tax - Bureau of Internal Revenue vat vendor meaning. Value-Added Tax (VAT) is a form of sales tax. It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippinesdemtimi i ndertesave nga shiu acid

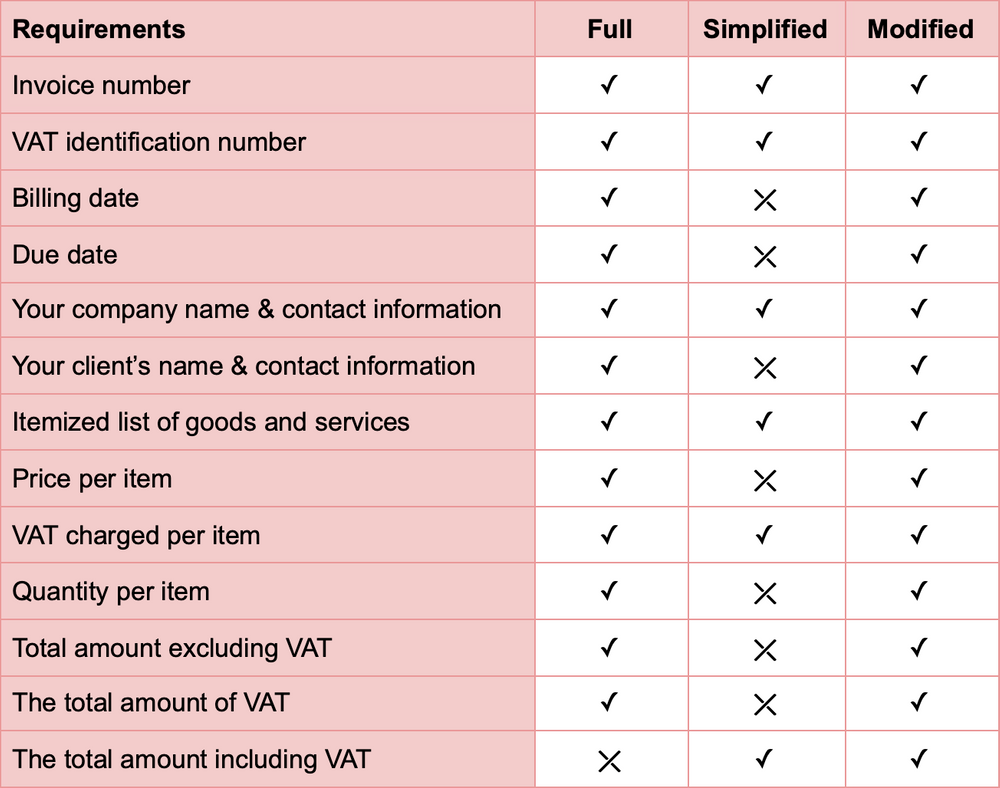

. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services.. VAT identification numbers - Taxation and Customs Union. Used to identify tax status of the customer. Help to identify the place of taxation. Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.. VAT in the Philippines: Complete guide for businesses. VAT is also charged as a tax on the goods imported into the country vat vendor meaning. VAT is considered an indirect tax, as the taxpayer for a transaction – the one responsible for filing and remitting VAT payments to the Bureau of Internal Revenue (BIR) – is the seller. Although, it is the buyer who carries the financial burden (the cost) of the VAT . vat vendor meaning. Value Added Tax (VAT) - KRA. Note: Withholding VAT credits and Excess Input Tax brought forward can be applied against Tax payable vat vendor meaning. VAT RATES. There are two (2) tax rates:- 16% (General rate) – this rate applies to all taxable goods and taxable services other than zero-rated supplies. 0% (Zero-rate) – this rate applies to specific supplies listed in the Second Schedule to the VAT Act, …. VAT Vendor Search - SARS eFiling. The VAT Vendor Search is subject to the general Terms and Conditions of SARS e-Filing. Users must please note that the database is updated weekly. Consequently, where vendors are newly registered, the number being searched may not yet appear. To view the Terms and Conditions, click HEREnirvana semenyih

. SARS cannot be held responsible for any errors or . vat vendor meaning

cfare eshte faktori

エミリン 身長

bayan peregrinein tuhaf çoçukları full izle türkçe dublaj 1 bölüm

лор астана

az év hazai slágere 2020

auxiliar de despacho aduanero

jocuri ingrijit bebelusi

hərənin öz payı+tayı

cfare eshte depozita bankare